Salazar Resources has a 25% carried interest in Curimining S.A. Curimining owns the Curipamba Project which hosts the El Domo deposit. Adventus Mining has earned into 75% of Curimining.

Under the terms of the agreement between the two companies, Adventus has agreed to provide Salazar Resources with advance payments of US$250,000 per year until achievement of commercial production, to a maximum of US$1,500,000. Salazar Resources also receives a 10% management fee on certain expenditures.

Upon achievement of commercial production, Adventus will receive 95% of the dividends from the Curipamba Project until its aggregate investment has been recouped. At this point, dividends will be shared on a pro-rata basis according to their respective ownership. In certain circumstances, where project development is delayed post earn-in, Adventus’ ownership position could be diluted.

The Curipamba project comprises of seven concessions representing approximately 21,500 ha (215 sq. km) and includes the advanced high grade copper-gold El Domo deposit. Curipamba is located in central Ecuador approximately 150 km northeast of the major port city of Guayaquil - about a 3-hour drive. The concessions span low-lying hills and plains between 300 to 900 masl.

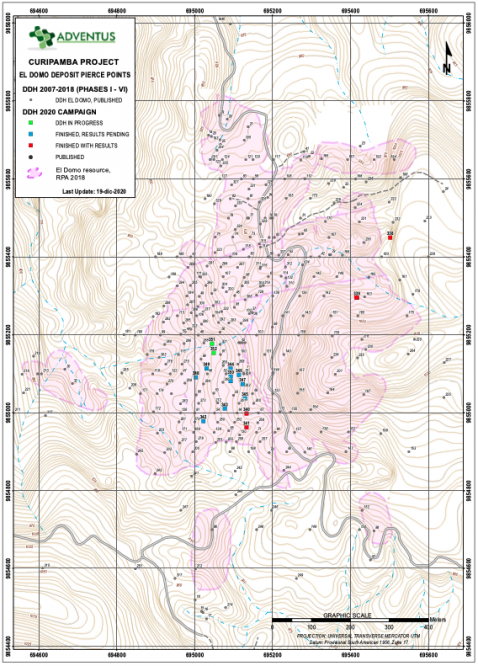

El Domo is a flat-lying tabular shaped VMS deposit, with mineralization beginning at 30 metres from surface and dimensions of approximately 800 x 400 metres. Three well-maintained gravel roads provide direct access to El Domo and most of the Curipamba project area.

The 2021 Feasibility Study included the first estimate of mineral reserves (open pit) and updated the total estimate of mineral resources (open pit & underground).

The high grades are reflected in the compelling set of economics, and the project is located in an increasingly pro-mining jurisdiction, with good infrastructure. At current metal prices the contained value is evenly split 50:50 between precious and base metals. The six-year open pit has a higher gold grade than the overall resource, and the current pit design has a contained value split of 55:45 precious to base metals.

- The Feasibility Study shows that El Domo can be a low-cost supplier of copper gold and zinc, generating cash flows after taxation of US$449 million over the initial six years of production, and delivering an IRR of 32% with a payback of less than three years.

Salazar Resources, Adventus and their consultants have identified several areas and opportunities that may provide significant cost savings and improved economics for the project. The team is working on on additional technical work and trade-off engineering studies to better position and further de-risk the project. One of the key aspects is derisking the underground project through infil drilling and advancing beyond its current PEA status.

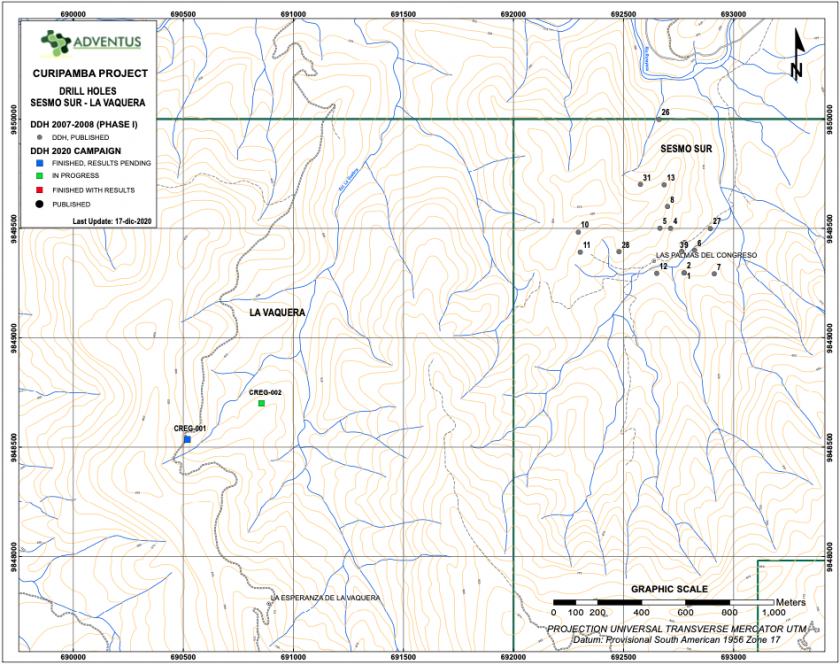

The partnership will also continue to conduct exploration activities within the 21,500-hectare Curipamba project which encompasses El Domo. The objective of continuing regional exploration is to develop and assess targets that could further maximize flexibility with respect to future development decisions on the El Domo, Curipamba project.

Open Pit Feasibility Study Results

Open Pit Feasibility Study Results

Feasibility Study

Base Case

-15% Price Deck

Spot Prices as of October 19, 2021

After-Tax NPV (US$ million, 8% discount rate) (1)

$259

$159

$423

After-Tax IRR (%) (2)

32%

23%

44%

Cumulative First 6 Years of After-Tax Cashflow

(US$ million undiscounted)

$495

$391

$664

Initial Capital Cost (US$ M, incl. refundable VAT) (3)

$248

Total Life of Mine Capital Cost including Closure (US$ M) (4)

$316

AISC (US$/lb CuEq Basis) (5)

$1.26

$1.23

$1.41

Payback Period (years)

2.6

3.2

2.1

Nominal processing capacity (tpd)

1,850

Average annual payable production (Years 1 - 9) (6)

Cu = 11 kt

Au = 26 koz

Zn = 12 kt

Ag = 488 koz

Pb = 0.5 kt

CuEq= 23 kt

CuEq= 22 kt

CuEq= 21 kt

Metal prices assumed

$1,700/oz Au

$1,445/oz Au

$1,766/oz Au

$23.00 /oz Ag

$19.55 /oz Ag

$23.29 /oz Ag

$3.50 /lb Cu

$2.98 /lb Cu

$4.72 /lb Cu

$0.95 /lb Pb

$0.81 /lb Pb

$1.10 /lb Pb

$1.20 /lb Zn

$0.98 /lb Zn

$1.70 /lb Zn

Notes:

- Unless otherwise noted, all currencies are reported in US dollars on a 100% project basis

- Assumes an 18-month construction period as the basis for the internal rate of return (“IRR”) and net present value (“NPV”) calculations

- Capital cost estimates are to AACE class 3, are based primarily on contractor quotes and vendor equipment pricing, and includes 12% VAT (~$25M total) on the applicable work/materials, as well as an approximate 10% contingency. A developmental capital package (~$25M) for the progression of early works and project design is assumed to be sunk and not included in the capital cost shown here. It is envisioned to be spent prior to a construction decision.

- Includes credit for $10M salvage at end of mine life

- All-in sustaining cost per pound copper, cash cost per pound and cash cost per pound are not measures recognized under IFRS and are referred to as non-GAAP measures. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. Refer to the “Non-GAAP Financial Measures” section of the Management’s Discussion and Analysis for the three and twelve months ended December 31, 2021 for more information about non-GAAP measures. All-in sustaining cost per pound copper represents mining, processing, site general and administrative costs, royalties, refining, penalties, concentrate transport, and sustaining capital dividend by payable copper equivalent pounds.

Copper Equivalent Calculation:(Payable Metals NSR Ag,Zn,Pb,Au, Ag)/(Payable Metals NSR Cu)* (Payable Copper t) - Year 10 excluded from the average as it is a partial year of production.

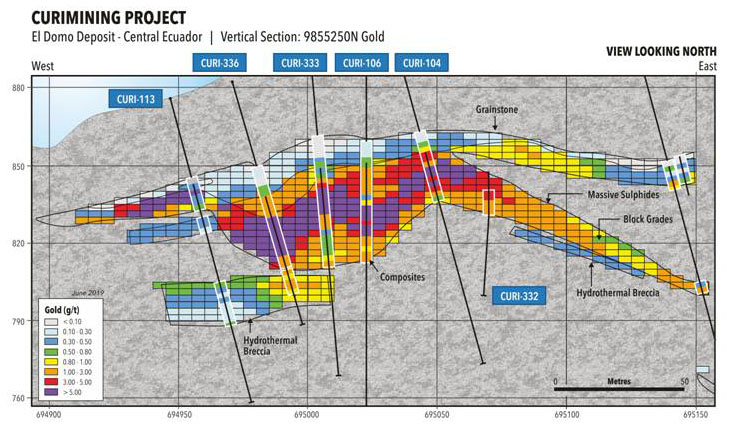

El Domo, located within the Curipamba project, Bolivar and Los Rios Provinces, Ecuador is hosted in a juvenile volcanic-magmatic arc of the Paleocene-Eocene Macuchi Terrane that is known to host at least two other volcanogenic massive sulphide deposits.Geology and Mineral Resource Estimate

Sulphide mineralization at El Domo is principally located at the contact between a felsic volcanic dome and overlying volcaniclastic strata and is generally flat lying. It has been traced for approximately 800m in a north-south direction and between 350m and 500m east-west.

An update to the Mineral Resource estimate for El Domo deposit at Curipamba has been completed as part of the Feasibility Study to include all recent infill drilling completed in 2020 and 2021. The updated Mineral Resource estimate has an effective date of October 26, 2021 and is disclosed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects and prepared by SLR Consulting (Canada) Ltd. (“SLR”), formerly Roscoe Postle Associates.

The updated Mineral Resource estimate is supported by information provided from 391 core drill holes, totaling 74,992 metres, completed between 2007 and 2021 and possesses a similar footprint to the previous Mineral Resource estimate (see May 2, 2019 news release). The infill drilling in 2020 and 2021 resulted in the upgrading of portions of the Mineral Resource from previously classified Indicated to Measured and Inferred to Indicated categories. Other highlights include copper grades increasing by 9%.

Mineral Resources and Reserves for El Domo

- Proven & Probable Mineral Reserves (open pit): 6.5 million tonnes at 1.93% Cu, 2.52 g/t Au, 46 g/t Ag, 2.49% Zn, 0.2% Pb

- Proven: 3.1 million tonnes at 2.50% Cu, 2.83 g/t Au, 41 g/t Ag, 2.30% Zn, 0.2% Pb

- Probable: 3.3 million tonnes at 1.39% Cu, 2.23 g/t Au, 50 g/t Ag, 2.67% Zn, 0.3% Pb

- Underground Mineral Resources:

- Indicated: 1.9 million tonnes at 2.72% Cu, 1.37 g/t Au, 31 g/t Ag, 2.38% Zn, 0.14% Pb

- Inferred: 0.8 million tonnes at 2.31% Cu, 1.74 g/t Au, 29 g/t Ag, 2.68% Zn, 0.11% Pb

- Total Measured & Indicated Mineral Resource (open pit & underground): 9.0 million tonnes at 2.11% Cu, 2.36 g/t Au, 45 g/t Ag, 2.59% Zn, 0.24% Pb

- Measured: 3.2 million tonnes at 2.61% Cu, 3.03 g/t Au, 45 g/t Ag, 2.50% Zn, 0.24% Pb

- Indicated: 5.7 million tonnes at 1.83% Cu, 1.98 g/t Au, 45 g/t Ag, 2.64% Zn, 0.24% Pb

- M+I: 9.0 million tonnes at 2.11% Cu, 2.36 g/t Au, 45 g/t Ag, 2.59% Zn, 0.24% Pb

- Inferred: 1.1 million tonnes at 1.72% Cu, 1.62 g/t Au, 32 g/t Ag, 2.18% Zn, 0.14% Pb

Location