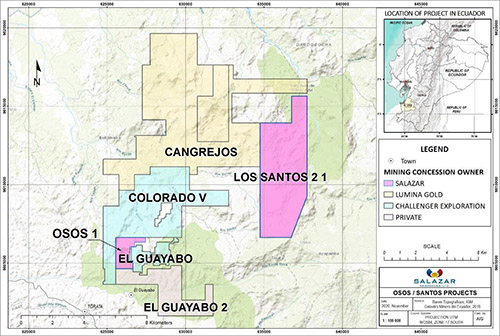

VANCOUVER, BRITISH COLUMBIA, December 10th, 2020 - SALAZAR RESOURCES LIMITED (TSXV: SRL) (Frankfurt: CCG.F) (“Salazar Resources” or the "Company") is pleased to announce it has significantly increased its total claim holdings in the Cerro Pelado gold district to 2,444 hectares (“ha”), having entered into a binding Letter of Intent (the “LOI”) with Minera Mesaloma S.A. (the “Vendor” or “Minera Mesaloma”) and been granted the option to acquire up to 100% of the Los Santos gold project (comprised of the Los Santos 2.1 concession) (“Los Santos” or the “Project”) near Salazar Resources’ Osos project, El Oro, Ecuador, subject to receipt of approval of the TSX Venture Exchange (the “TSXV”). The Company believes that Los Santos and Osos provide Salazar Resources with all the necessary land that would be required to facilitate the development of a deposit (see Figure 1).

Highlights

- Los Santos is adjacent to identified mineral resources at Lumina Gold’s 17 million ounce Cangrejos project (10.4 million oz indicated and 6.6 million oz inferred - see Lumina Gold’s news release dated June 9, 2020), and in close proximity to Salazar Resources’ Los Osos property;

- Strategic concession in prolific gold-copper-rich porphyry region;

- Abundant quartz-pyrite stockworks, underground workings on fault and vein structures, and breccia-hosted copper-gold mineralization identified;

- Potential continuation of mineralization and structure from Cangrejos into Los Santos ;

- Location/infrastructure – established mining region – good road access and accessible grid power;

- Existing databases of historical information are currently being reviewed and should enable accelerated target development; and

- Salazar Resources can potentially earn up to a 100% interest in the Los Santos property via a staged option payment schedule (see “Transaction Terms” below)

Fredy E. Salazar, President and CEO of Salazar Resources said, “Los Santos contains a large mineralizing system, similar to that of the adjacent Cangrejos deposit and Salazar Resources’ Los Osos project. Francisco Soria and I were involved in the exploration of this region in the 1990s and we know that there is fantastic potential here which has hardly been tested. Despite multiple artisanal workings and widespread mineralized stockworks and breccias, neither Los Santos nor Los Osos have been drilled before now, providing significant upside potential rapidly and at relatively low cost, given our deep understanding of the geology in the region. With the addition of the 2,215 hectares at Los Santos, Salazar Resources now has an important land package in this emerging gold province.”

“The earn-in LOI also reinforces Salazar Resources’ credentials as a partner of choice in Ecuador. The fact that the Vendor chose to work with Salazar Resources demonstrates that we are being trusted to make discoveries and to manage the project in a way which has a positive impact on local communities.”

“I look forward to keeping the market informed as we integrate Los Santos into the exploration plans for 2021 and beyond.”

LOS SANTOS 2.1

Los Santos lies in southwest Ecuador between the towns of Pasaje and Paccha in a district with a well-established tradition of gold panning and artisanal gold mining. The northwest portion of the concession area is less than 2 km from the centre of the Cangrejos main mineral resource, held by Lumina Gold. The project area is accessed via gravel roads, with elevations between 360 m and 1766 m, and there is a prominent north-south-trending ridge extending through the centre of the concession.

The Los Santos concession was originally held by a private company, Ecuanor, in the early 1990s before being transferred to Minera Mesaloma in 2005. The area has been subject to surface exploration (geological mapping, soils and stream sediment geochemistry sampling and analyses, and regional magnetic and VLF electromagnetic surveys), principally on the east side of the property. Historic exploration data generated by Newmont Corporation and Compania Minera Silex Ecuador S.A. have been integrated into the database.

| Figure 1. Location of Los Santos 2.1 in the Cangrejos district |

|

| Source: Salazar Resources Ltd. |

Geology

Anomalous gold and copper-gold results are widespread in the area and occur within the intrusions and adjacent volcanic and metamorphic rocks. Many of the target areas appear to be associated with nested circular features interpreted to be a collapse structure or caldera margin. Salazar Resources’ geologists confirm that the geology at Los Santos is similar to that of Cangrejos and Los Osos being gold-copper, silica-saturated, alkalic porphyry-style mineralization with abundant evident of mineralised hydrothermal breccias.

Exploration work to date completed by others has identified a number of targets, including the Puntudo, Reventazon, and Giomar zones, mostly on the eastern portion of the Los Santos concession. Limited exploration has been carried out on the western portion of the concession. At Puntudo, locally intense quartz and pyrite veining are present in float and widely scattered outcrop over 500 m x 300 m. Gold values range from background to 3.2 g/t gold, coincident with pathfinder element anomalies including arsenic and copper. The Giomar target is a zone of discontinuous quartz and pyrite veining about 250m in diameter. Gold values from a variety of grab, selective and channel samples range up to 3.3 g/t gold, with highly anomalous arsenic. Pathfinder element anomalies suggest a potentially larger area of interest.

Historic Work

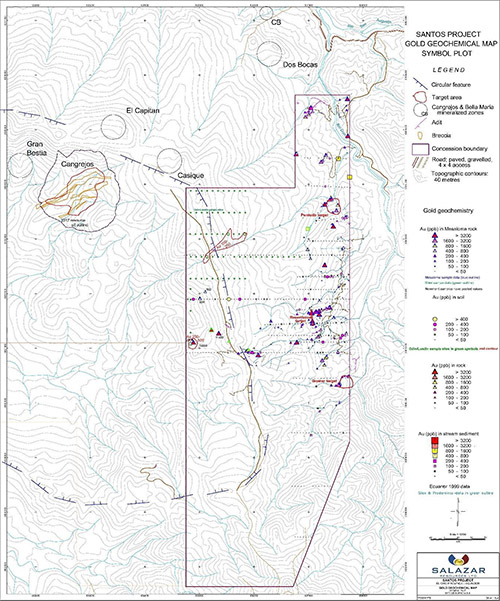

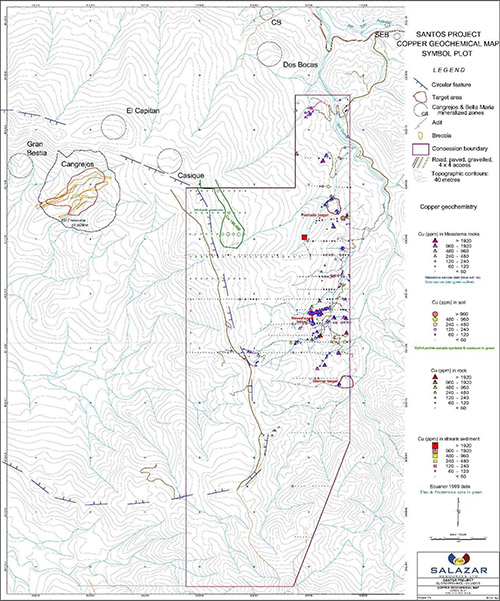

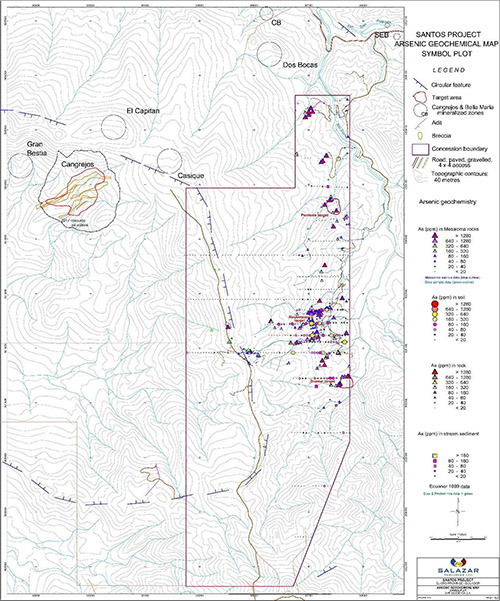

A program of geochemical soil and rock sampling was conducted on the former Los Santos concession during the period 1996 to 1999 and which covered the eastern part of the current Los Santos concession. Flagged and/or cut lines were established at intervals of 100 to 1000 metres. Soil samples were collected with an auger at 50 metre intervals. Rock samples were collected where any mineralization or alteration of interest was noted.

Results of historic sampling over the concession and adjacent area are presented as gold, copper and arsenic symbol plots in Figures 2-4. These plots include all available data including Minera Mesaloma`s sampling and data which the Company has assumed to be reliable and which has been acquired from other sources. A few lines of soil sampling conducted by Odin Mining & Exploration Ltd. (now Lumina Gold Corp.) cross onto the Los Santos concession, as shown on the gold and copper plots. A qualified person has not yet had the opportunity to verify the historic data for Salazar Resources, and Salazar Resources intends to test the areas with fresh sampling and work. The figures are included for illustrative purposes only and to demonstrate the partial extent of historic work on the area.

The gold plot (Fig. 2) shows widespread scattered anomalies (+500 ppb in soil, rock and stream sediment) throughout the Giomar, Reventazon and Puntudo areas as well as in two additional areas on the western side of the property. Several anomalous gold values also occur on the historic and unverified Odin lines on the west side of the concession.

Anomalous copper values (+120 ppm) occur in Reventazon and Giomar, in the area intermediate to these anomalies and an anomalous zone on the west side coincident with the gold anomalies (Fig. 3). Anomalous values of 100 to 500 ppm Cu were obtained on several of the historic and unverified Odin lines in the northwest corner of the concession.

Arsenic, a gold pathfinder element, shows (Fig. 4) a large zone of moderately to highly anomalous values in soil and rock (+20 ppm As to >1280 ppm As) between Reventazon and Giomar. Antimony and bismuth, also gold pathfinder elements (if greater than >2 ppm), are anomalous in recent rock sampling carried out by Minera Mesaloma.

| Figure 2. Los Santos, Gold Geochemistry |

|

| Source: Minera Mesaloma S.A. |

| Figure 3. Los Santos, Copper Geochemistry |

|

| Source: Minera Mesaloma S.A. |

| Figure 4. Los Santos, Arsenic Geochemistry |

|

| Source: Minera Mesaloma S.A. |

Transaction Terms

The option payments to be made by Salazar Resources to Minera Mesaloma under the LOI are as follows:

| Amount (US$)(1) | Option Payment Due Date | SRL ownership |

| $25,000 cash | Paid | |

| $50,000 | Within 2 business days of the later of receipt of TSXV approval and December 23rd , 2020 (the “Due Diligence Deadline”), the date by which Salazar Resources is to have completed its due diligence investigation | |

| $150,000 | Due on the later of: (a) 1 year from date of execution of the definitive agreement that shall supersede the LOI; and (b) the date which falls 12 months after the date when a permit is granted to enable the conduct of exploration activities on the Project that includes drilling. This is a committed option payment. | 26% |

| $250,000 | Anniversary of previous payment | 51% |

| $350,000 | Anniversary of previous payment | 61% |

| $500,000 | Anniversary of previous payment | 80% |

| $700,000 | Anniversary of previous payment | 90%(2) |

Notes:

- For payments subsequent to the initial US$25,000 cash payment, Minera Mesaloma can choose to receive payment in units of the Company (“Units”), with each Unit being comprised of a) one common share of the Company (a “Salazar Share”) plus b) one-half one of one share purchase warrant (each whole warrant, a “Warrant”), provided that upon issuance of the Units, Minera Mesaloma shall not end up owning in excess of 9.9% of the then issued and outstanding Salazar Shares, calculated on a partially diluted basis assuming exercise of the Warrants. The number of Units deliverable shall be calculated using a price per Unit equal to a 7.5% discount on the 5 day volume weighted average price of the Salazar Shares on the TSXV as of the business day prior to the applicable payment date (the “Current Market Price”). Each Warrant will be exercisable for 18 months from the date of issue to purchase one Salazar Share at an exercise price equal to the greater of the Current Market Price or the market price of the Salazar Shares at the time of issuance of the Warrants .

- The payment schedule set out above may be accelerated by Salazar by paying an additional 30% or 25% premium on the remaining option payments ahead of the Fourth anniversary (80%) or Fifth anniversary (90%) payments respectively.

- On Salazar Resources having paid the fifth anniversary payment and thereby earned a 90% interest in the Los Santo 2.1 property, Salazar Resources has the option to purchase the remaining 10% of the property for US$2,000,000 plus an 1.5% NSR royalty, where each 0.5% can be repurchased by Salazar Resources for the cash sum of US$1,250,000. Once Salazar Resources has paid the fifth anniversary payment, or if the Project has commenced commercial production prior to Salazar Resources having paid the fifth anniversary payment, both Parties will thereafter fund the project on a pro-rata basis.

- If and when Minera Mesaloma is diluted to a 3% interest in the Los Santos 2.1 property, then Minera Mesaloma’s interest in the property will be converted into a 1.5% NSR royalty where each 0.5% of such royalty can be repurchased for a cash sum of US$1,500,000; payments under each 0.5% NSR royalty shall be capped at US$4,500,000 when paid out from production.

- On Salazar Resources having paid the fifth anniversary payment and thereby earned a 90% interest in the Los Santo 2.1 property, Salazar Resources has the option to purchase the remaining 10% of the property for US$2,000,000 plus an 1.5% NSR royalty, where each 0.5% can be repurchased by Salazar Resources for the cash sum of US$1,250,000. Once Salazar Resources has paid the fifth anniversary payment, or if the Project has commenced commercial production prior to Salazar Resources having paid the fifth anniversary payment, both Parties will thereafter fund the project on a pro-rata basis.

Exploration Programs at Los Santos 2.1

Exploration Activities at Los Santos will be governed by a Steering Committee composed of three members, two of whom shall be appointed by Salazar Resources and one of whom shall be appointed by Minera Mesaloma. Salazar Resources shall be the operator, and it is to conduct an initial exploration program focusing on geochemical sampling, mapping, and target generation. Once Salazar Resources has completed the first phase of exploration, Salazar Resources will propose further work programs to be carried out in accordance with the plan developed by the Steering Committee.

Salazar Resources will integrate exploration work at Los Santos with exploration at its other projects. Given that Salazar Resources is intimately knowledgeable about the regional geology and mineralization, and is currently drilling at Los Osos, the Company anticipates that drill target delineation in the project area will be completed during the course of 2021.

About Salazar Resources

Salazar Resources (SRL.V) (CCG.F) (SRLZF) is focused on creating value and positive change through discovery, exploration and development in Ecuador. The team has an unrivalled understanding of the geology incountry and has played an integral role in the discovery of many of the major projects in Ecuador, including the two newest operating gold and copper mines.

Salazar Resources has a wholly-owned pipeline of copper-gold exploration projects across Ecuador with a strategy to make another commercial discovery and farm-out non-core assets. The Company actively engages with Ecuadorian communities and together with the Salazar family it co-founded The Salazar Foundation, an independent non-profit organisation dedicated to sustainable progress through economic development.

The Company already has carried interests in three projects. At its maiden discovery, Curipamba, Salazar Resources has a 25% stake fully carried through to production. A feasibility study is underway and a 2019 preliminary economic assessment generated a base case NPV (8%) of US$288 million. At two copper-gold porphyry projects, Pijili and Santiago, the Company has a 20% stake fully carried through to a construction decision.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Qualified Person

Kieran Downes, P. Geo., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure set out in this news release.

Forward-looking Information

This press release contains “forward -looking information” within the meaning of applicable Canadian securities laws. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “believes”, “anticipates”, “expects”, “is expected”,

“scheduled”, “estimates”, “pending”, “intends”, “plans”, “forecasts”, “targets”, or “hopes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “will”, “should” “might”, “will be taken”, or “occur” and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking information herein includes, but is not limited to, statements that address activities, events, or developments that Salazar Resources expects or anticipates will or may occur in the future. Although Salazar Resources has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Salazar Resources does not undertake to update any forward-looking information except as required in accordance with applicable securities laws.